Nvidia shares fall after China opens probe in possible antimonopoly violation

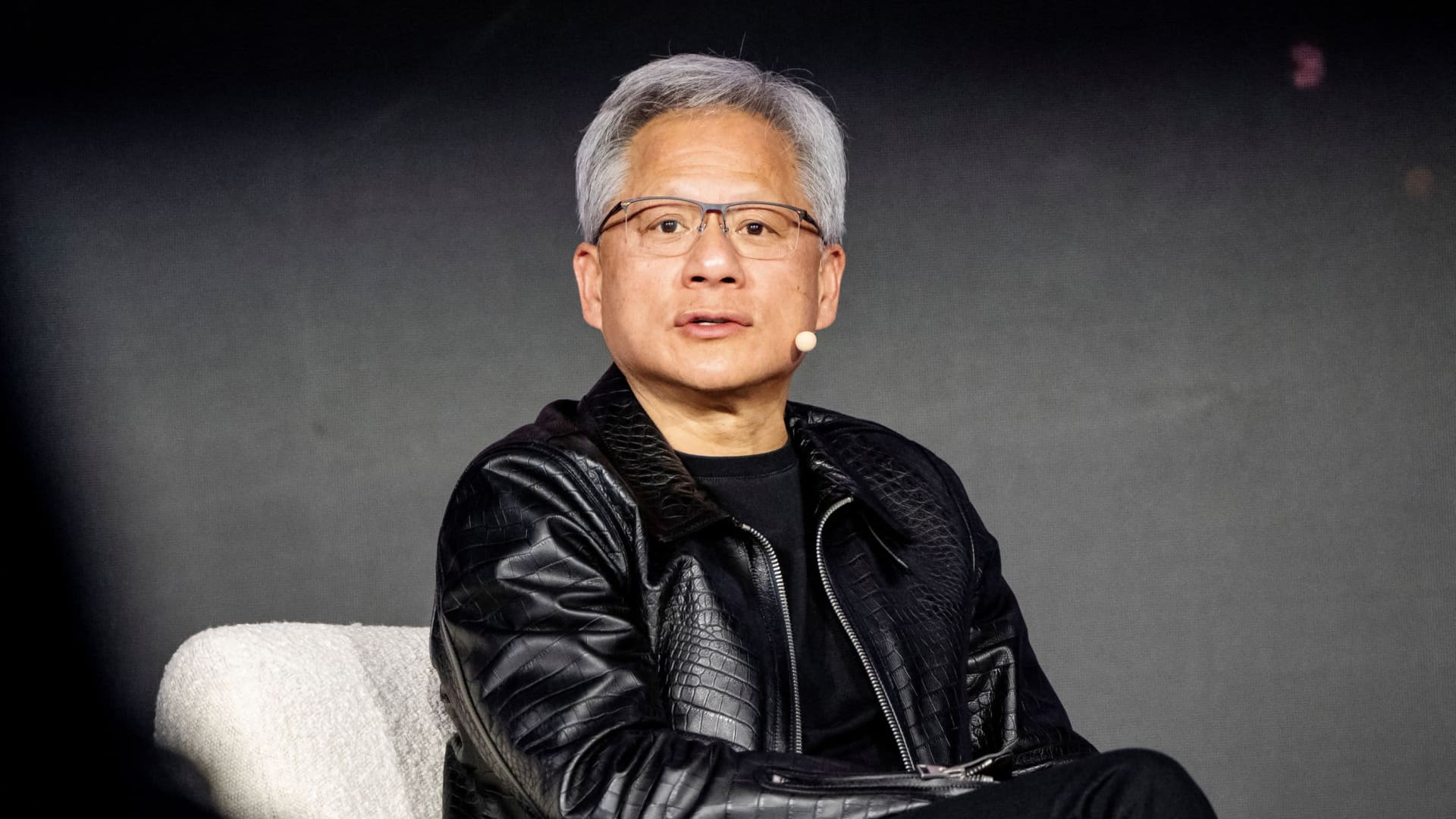

Jensen Huang, Nvidia’s founder, president and CEO, speaks about the future of artificial intelligence and its effect on energy consumption and production at the Bipartisan Policy Center in Washington, D.C., on Sept. 27, 2024.

Chip Somodevilla | Getty Images

Nvidia shares were under pressure Monday after a regulator in China said it was investigating the chipmaker over possible violations of the country’s antimonopoly law.

Shares declined more than 2%.

The State Administration for Market Regulation opened an investigation into the chipmaker in relation to the acquisition of Mellanox and some agreements made during the acquisition, the Chinese government said Monday. Nvidia acquired the Israeli technology company that creates network solutions for data centers and servers in 2020.

“In recent days, due to Nvidia’s suspected violation of China’s anti-monopoly law and the State Administration for Market Regulation’s restrictive conditions around Nvidia’s acquisition of Mellanox shares … the State Administration for Market Regulation is opening a probe into Nvidia in accordance with law,” according to a statement translated by CNBC.

The news comes as competition heats up between the U.S. and China over chipmaking capabilities, with the Biden administration on Dec. 2 announcing a final slew of curbs targeting semiconductor toolmakers. The news could also be a response to mounting trade tensions as President-elect Donald Trump readies for office in January, promising to slap hefty tariffs on foreign goods.

The U.S. has amped up restrictions on chip sales to China in recent years, barring Nvidia and other key semiconductor manufacturers from selling their most-advanced artificial intelligence chips in an effort to limit China from strengthening its military. The company has worked to create new products to sell in China that abide by the U.S. regulations.

Shares of the AI chip darling have outperformed this year, rallying nearly 188% as investors ramp up bets on the sector more than two years after the debut of ChatGPT. Shares have also helped push the market to new highs, along with the broader technology sector.

Nvidia did not immediately respond to CNBC’s request for comment.

— CNBC’s Evelyn Cheng contributed reporting.